What is the real cost of losing an employee?

Generally speaking, turnover costs can be divided into four categories: separation, replacement, training, and productivity costs. Separation costs may include COBRA benefits continuation, the expense of conducting exit interviews and in some cases even unemployment compensation. Replacement costs include job advertising, pre-employment testing and the time to prepare and produce materials for new hire orientation. Training costs include the time and effort from trainers, supervisors, and co-workers. Productivity costs more difficult to quantify but can include things such as moral problems, lower production, increased error rates, effects on the corporate reputation and perhaps client/customer migration.

So, how much does employee turnover cost your business?

Sadly, employee replacement cost is likely more than you think. Research indicates that the average cost to replace an employee (i.e. employee turnover) is about 50 percent of that employee’s annual salary.

The following table (SHRM) classifies the breakdown of replacement costs an employer might incur to replace employees at different levels within an organization:

|

Position Type |

Average Replacement Cost |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

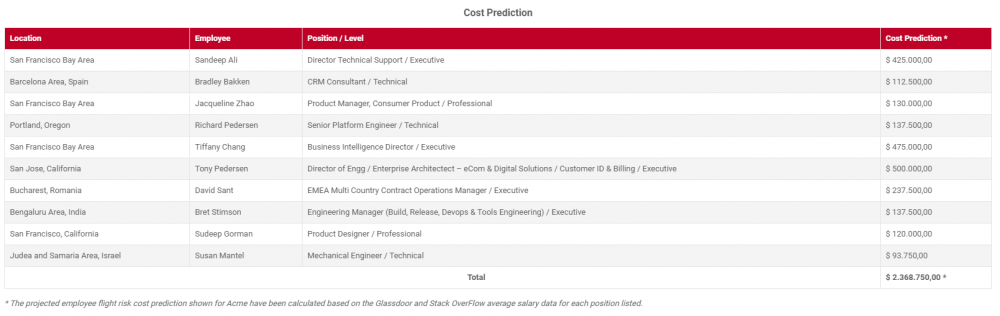

Here is retainable.ai’s cost prediction table for the people at high risk to leave in order to help companies understand the economic value of employee retention issue;

Categorizing employee turnover costs

The direct and indirect costs associated with replacing an employee can be generally sorted into one of four categories: separation costs, recruitment costs, training costs and productivity costs. The following list a number of items under each heading that should be taken into consideration as you calculate your employee turnover expense.

Separation costs

As an employer, you incur a number of costs when an employee leaves your organization, including removing the employee from payroll or benefits systems, conducting exit interviews plus the time other employees spend processing the employee’s termination. In certain circumstances, the exit may also include severance pay, costs associated with unemployment insurance claims and the expense of continued benefits, etc. In essence, every employee that leaves an organization, even those who retire, cause an employer to incur at least some expenses related to the separation.

Recruitment costs

Now that you have a newly vacant position the recruitment costs an employer incurs to look for someone to fill the role come into play. Expenses in this regard can add up and include everything from the cost of developing an updated job description to the cost of training the new employee, and everything in between.

Consider that every open position you have will take up hours and hours of work for recruiters, HR professionals and hiring managers. They will have to screen applications and resumes, deliberate and narrow down the applicant pool to a ‘short list’, schedule and participate in interviews, and then meet again to select a candidate. And that’s if you have a simple, efficient hiring experience. In today’s competitive job market many employers often use advanced screenings to assess the skill sets and personalities of applicants. You may also have a promising candidate who needs to travel some distance to meet with multiple people within the organization prior to making an offer. The longer the hiring process, the more expensive it becomes.

Training Costs

As you can imagine, no two positions and no two employees are alike. Additionally, a wide number of differences in candidate skills, along with the demands of the position, can impact the cost of training. Entry and non-skill level workers, such as warehouse hands, may be trained quickly on the job. In contrast, it could take weeks of classroom training to instruct an insurance underwriter about your process of screening applicants because of the complexities and corporate guidelines involved with the job.

The nature and scope of training necessary to bring an employee up to speed also impact costs. On the job training, where workers perform their tasks and learn as they go, is relatively affordable, while lengthy induction training – when the employer provides for workers before they’re ready to begin job functions – can be costly. In addition to the entry wages you pay trainees, you must also cover salaries cost for training staff, productivity time compensation of co-workers involved in training, as well as the cost of off-site courses.

Productivity costs

The most difficult costs to identify are those related to productivity. This category not only includes the hours of lost productivity that rack up as a position remains unfilled but also the time other employees spend trying to pick up the slack. The major point to remember in calculating this expense is that employers don’t just lose a worker when an employee leaves – they also all of the experience and expertise that employee brought to their job, any costs associated with employer-provided training, along with the trust/sales relationship that employee had with customers.

Muttalip Olgun

Founder & Ceo @Retainable